President Lee Chang-yong “Taeyoung Construction’s real estate PF insolvency crisis is unlikely to spread financial instability”

Governor Lee “The Bank of Korea is not in a position to take an active role in the real estate PF issue” However, the market is still concerned about Taeyoung's real estate PF insolvency crisis In particular, there is a growing concern about the ‘secondary financial sector’, which is more vulnerable to crisis response

Bank of Korea Governor Lee Chang-yong emphasized that it is not time for the Bank of Korea to step in, saying that Taeyoung Construction’s workout (corporate structure improvement) situation is unlikely to spread into an overall system risk. However, in the market, voices raising concerns about PF insolvency in the financial sector are not fading due to the proportion of PF maturing in the first half of this year and the worsening external environment due to the high interest rate trend. In particular, there is analysis that the crisis may begin in the secondary financial sector, which is inevitably more vulnerable to crisis response.

Governor Lee “We have cannons and rifles, but they are not even big enough to use rifles”

On the 11th, at a press conference regarding the direction of monetary policy held at the Bank of Korea, Governor Lee diagnosed Taeyoung Construction’s real estate PF insolvency and explained the impact it would have on the overall financial market. Regarding the Taeyoung Construction incident, he said, “It is a representative example of poor risk management among real estate project financing (PF),” and said, “It is unlikely that the Taeyoung Construction incident will spread into a major crisis in the real estate PF and construction industry and spread into a systemic crisis.”

Although the Bank of Korea is the institution that responds policy-wise when an incident that could lead to market instability occurs, Governor Lee explains that the current Taeyoung Construction incident is not at the level of causing market instability. He said, “If an individual case leads to market instability, the Bank of Korea acts as a market safety valve, but that is not the case now.” He added, “You can fire a cannon or block it with a rifle, but it means that there is no point in using a rifle right now.” said.

In light of the Bank of Korea’s recent efforts to support small and medium-sized businesses by using the reserve portion of the financial intermediary support loan limit, it has also been interpreted that it has taken preemptive measures due to concerns about the impact of the Taeyoung Construction incident on the market. Governor Lee said, “I hope that the decision to support the financial intermediary support loan is not connected to the Taeyoung Construction problem,” adding, “The decision to provide support is to selectively and temporarily target local small and medium-sized businesses that may be relatively vulnerable because high interest rates will remain for a considerable period of time.” “The intention is to provide support,” he said.

Meanwhile, the Bank of Korea held its first monetary policy direction decision meeting of the new year and froze the base interest rate at 3.50% per annum. Except for Governor Lee, all five members of the Monetary Policy Committee expressed the opinion that it is necessary to solidify the basis for price stability by freezing interest rates for the next three months at the 5% level. In addition, regarding the timing of the base interest rate cut, all members of the Monetary Policy Committee expressed the position that the discussion of the interest rate cut itself was premature. In particular, Governor Lee stated, based on his personal opinion, “It does not seem easy to lower the base interest rate for at least six months.”

Concerns are not dispelled market atmosphere “PF maturity exceeds KRW 12 trillion in the first half of this year alone”

However, there are constant voices in the market raising concerns about PF insolvency in the financial sector due to the Taeyoung Construction incident. This is because the external environment is not favorable, as the proportion of PF maturing in the first half of this year is high and the high interest rate trend that has continued since last year continues.

According to a recent trend report published by the Korea Construction Industry Research Institute, the size of real estate PF is KRW 130 trillion, of which bridge loans amount to KRW 30 trillion and main PF amounts to KRW 100 trillion. Here, the maturity extension rates of bridge loans and main PF loans reach 70% (approximately 21 trillion won) and 50% (50 trillion won), respectively. As the maturity extension rates are high, concerns about actual insolvency are bound to increase. In addition, the fact that the balance of real estate PF loans in the financial sector is rapidly increasing is also a cause for concern. The balance of real estate PF loans in the financial sector, which was KRW 2020 trillion at the end of 92, increased by more than 5,000% compared to the previous year to KRW 9 trillion at the end of September last year.

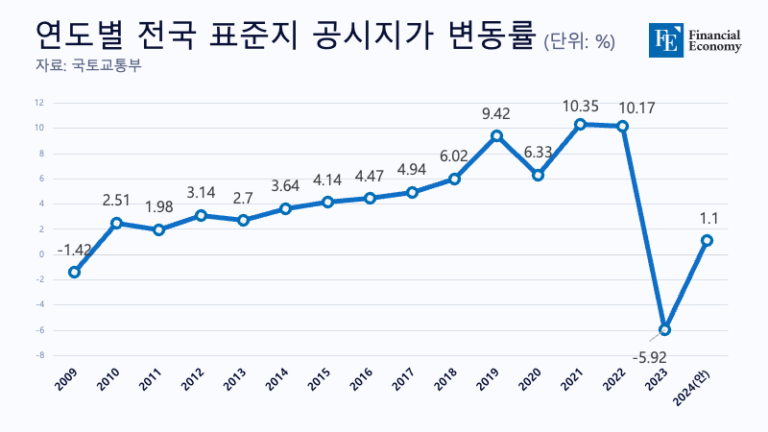

In this situation, as expectations for a recent interest rate cut have weakened, even the real estate market is showing signs of a recession. According to the Housing Industry Research Institute (JUSAN), the nationwide apartment occupancy rate in December last year was 12%, down 67.3 percentage points from the previous month (72.3%), and the decline was especially noticeable in Seoul, Incheon, and the Gyeonggi area, where major PF projects are concentrated. An official from Joosan Research Institute analyzed, “It appears that the transaction cliff has deepened due to the negative news of real estate PF insolvency in the housing market, which was contracted due to the economic recession and high interest rates.”

An ant hole can collapse a large dam.

Currently, what the market is most concerned about is the ‘insolvency bombing’ of second-tier financial institutions, which are inevitably more vulnerable to crisis response. This is because secondary financial institutions such as insurance companies, securities companies, credit card companies, and Saemaeul Geumgo, rather than primary financial institutions, currently account for the majority of institutions handling loan extensions.

According to a recent Korea Ratings survey, out of 23 trillion won in PF risk exposure (based on the combined amount of loans and debt guarantees) held by 24 domestic securities firms, 6 trillion won will mature by the end of June this year. Among these, bridge loans amount to 11 trillion won, accounting for more than 9,000% of the total. A bridge loan is funds received before a real estate development project begins construction, and the developer invests these funds into land purchase, business licensing, and construction company deposits before transferring them to the main PF of a first-tier financial institution. The loan period is usually short, at one year, and the interest rate is high, so the risk of default is higher.

Among secondary financial institutions, there are many concerns about local safes, especially those with weak capital. Unlike commercial banks, Saemaul Geumgo is an independent company for each vault, and in the case of regional vaults, the standard for new establishment is 2 to 150 billion won, which means the amount of equity capital is small. According to the Korea Development Bank, there are a total of 200 local safe deposit boxes that have provided loans to businesses in which Taeyoung Construction participated as a construction company and jointly provided a guarantee, with the loan size reaching 174 billion won. The Korea Development Bank estimates that among the 3,764 creditors of Taeyoung Construction, there are 600 to 300 of them, which accounts for more than half of the mutual creditors.

However, Saemaul Geumgo claims that it is unlikely to be greatly affected by the Taeyoung Construction incident. An official at Saemaeul Geumgo said, “There is a high possibility that Taeyoung Construction’s guaranteed debt for several vaults, including Yongin Saemaeul Geumgo and Seongnam Saemaeul Geumgo, that are currently being raised in the market will be recovered in the future.” He added, “Currently, Taeyoung Construction is in the workout phase, but its construction capabilities are limited. Since it has not been lost, it is expected that most of the deposit’s guaranteed debt will be recovered once construction is completed,” he explained.

네이버계정으로 로그인하기

네이버계정으로 로그인하기

카카오톡 계정으로 로그인하기

카카오톡 계정으로 로그인하기